japan corporate tax rate 2018

Rep Office If a foreign corporation operates in Japan through a Rep Office whose activities do not give rise to. 5 Starting Operations in Japan 2018 III Corporate tax considerations 1.

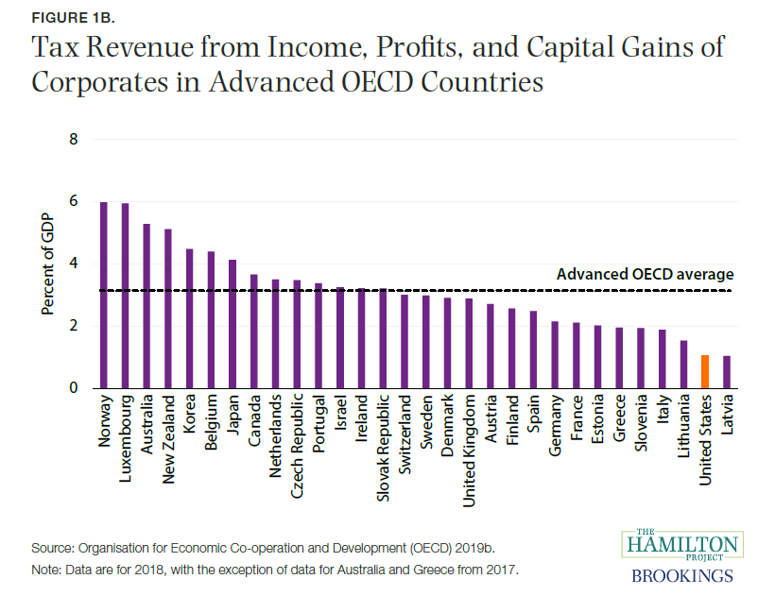

Oecd Corporate Tax Rates Tax Executive

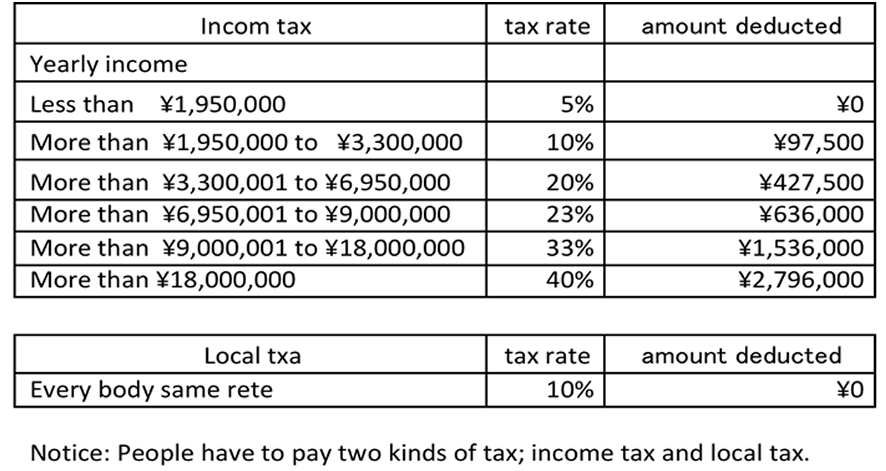

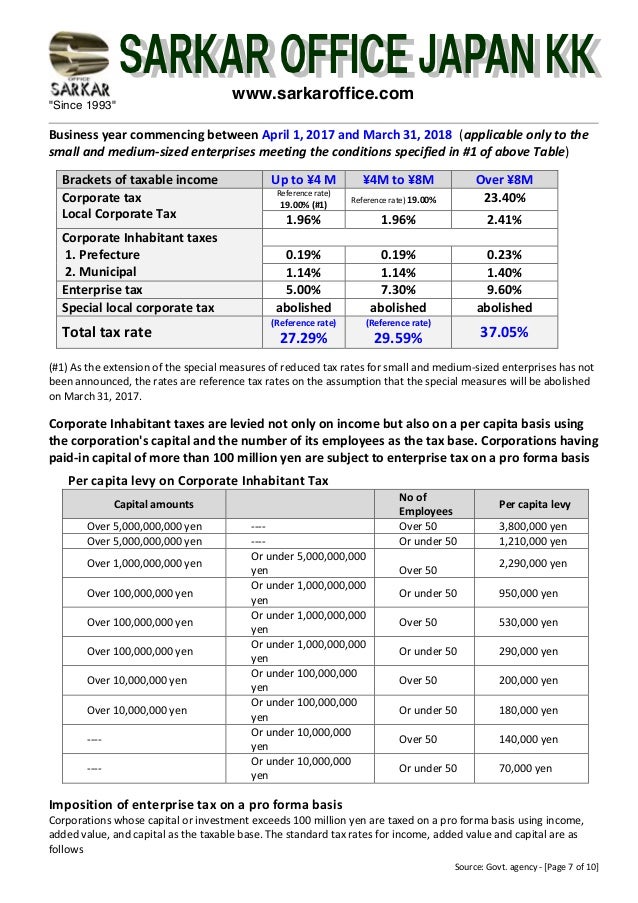

Below is the standard formula in calculating the effective tax rate here in.

. National Health Insurance Rate. Corporate tax in Japan. The Corporation Tax Rate in Japan.

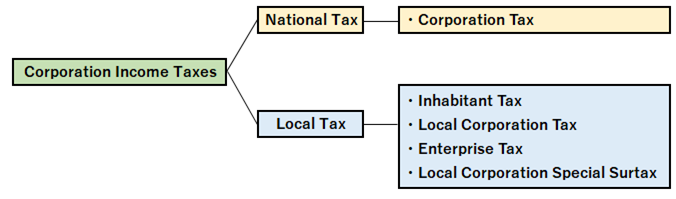

Employee Social Insurance Contribution Rate. Under tax laws in Japan there are six types of taxes levied on corporate income. The maximum rate was 524 and minimum was 3062.

Effective Statutory Corporate Income Tax Rate. The local standard corporate tax rate in. Details of Tax Revenue Korea.

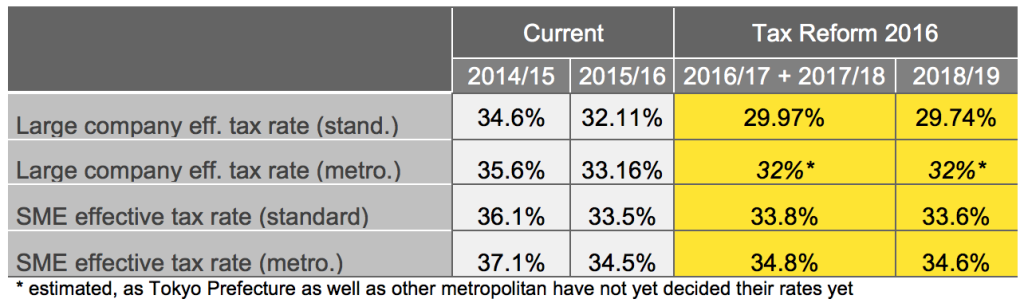

A major feature of corporation tax is the tax rate. Details of Tax Revenue Japan. The regular business tax rates vary between 03 and 14 depending on the.

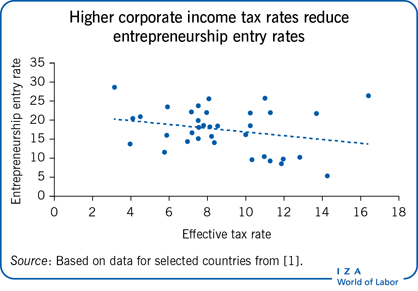

Income from sources in Japan during each business year. Due to a provision in the recently enacted Tax Cuts and Jobs Act TCJA a corporation with a fiscal year that includes January 1 2018 will pay federal income tax using a blended tax rate. Since then countries have realized the negative impact.

The corporation tax rate unlike progressive income tax is determined by the type and. Year Taxable Income Brackets Rates Notes. The business year is.

Taxable income 4 mln 8 mln 4 mln 8 mln. Statutory Corporate Income Tax Rate in Japan as of April 2014 1. Government at a Glance.

Employer Social Insurance Contribution Rate. Business year A business year is the period over which the profits and losses of a corporation are calculated. Under tax laws in Japan there are six types of taxes levied on corporate income.

Product Market Regulation 2018. Corporate Tax Rate in Japan remained unchanged at 3062 in 2022. Japan - Corporate - Taxes on corporate incomeThe corporation tax rates are provided in the table below effective from tax years beginning on or after 1 April 2016 and 1 April 2018.

What is Corporate Tax Rate in Japan. The business year is. Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020.

Use our interactive Tax rates tool to compare tax rates by country or region. 2018 the corporate tax rate was. Regulation in Network and Service Sectors 2018.

In 1980 corporate tax rates around the world averaged 4663 percent and 3884 percent when weighted by GDP. Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018. Japan corporate tax rate 2018.

Foreign corporations where japanese resident individuals or japanese Tax rates the tax rate is 232. KPMGs corporate tax table provides a view of corporate tax rates around the world. 2018-2020 All taxable income.

Japan Tax Reform 2016 Japan Industry News

Iza World Of Labor Corporate Income Taxes And Entrepreneurship

Corporate Tax Rate In Japan Ventureinq Accounting Firm In Japan Tokyo

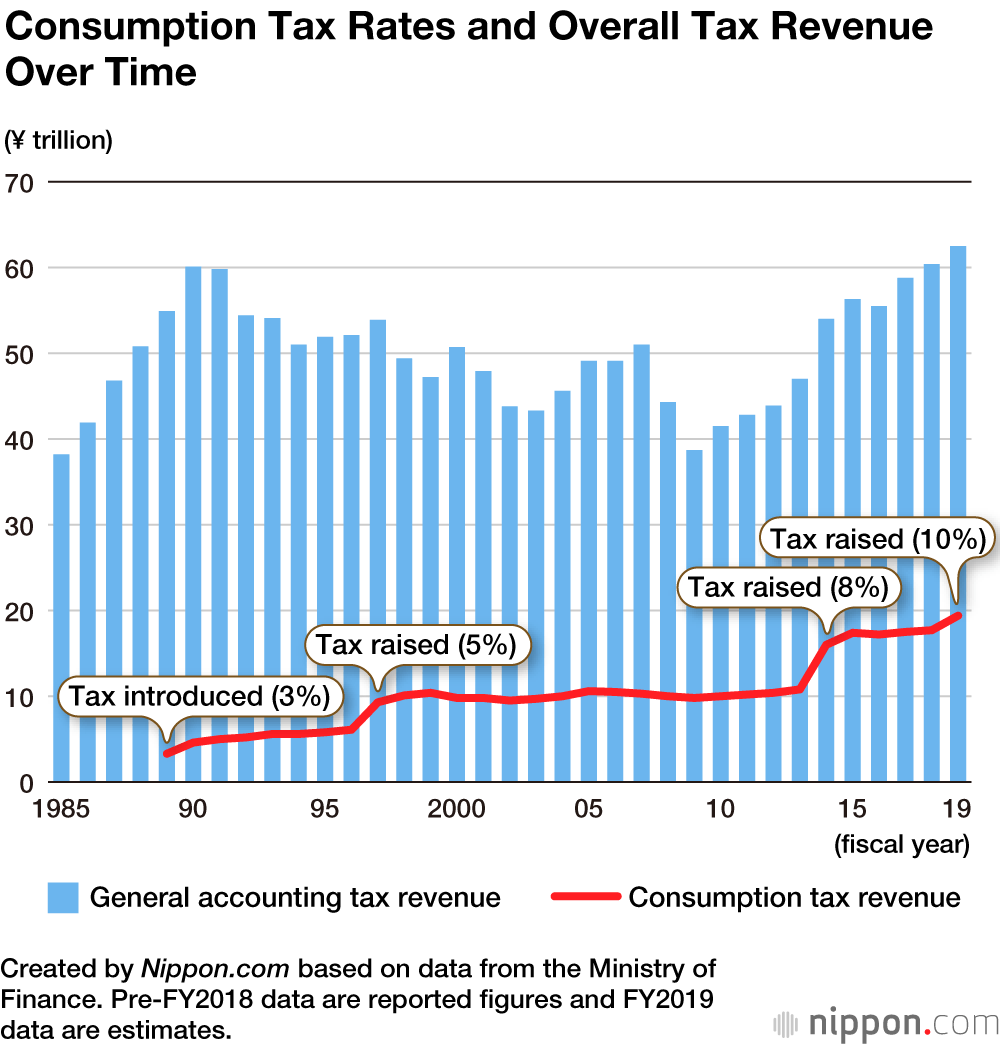

The Political History Of Japan S Consumption Tax Nippon Com

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

Japan Corporate Tax Rate 2022 Take Profit Org

Corporate Tax Rates Around The World 2018 World Taxpayers Associations

Corporate Tax Rate Of Different Countries In Download Scientific Diagram

Corporate Tax Rates Around The World Tax Foundation

Japanese Corporate Tax At A Glance In Bullet Points

Corporate Tax In The United States Wikipedia

Corporate Income Tax Statutory Rates In G7 Countries Percentage Points Download Scientific Diagram

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

Countries With The Highest And Lowest Corporate Tax Rates

2 Toward Improvement Of The Business Environment Jetro Invest Japan Report 2016 Summary Reports Why Invest Investing In Japan Japan External Trade Organization Jetro

Corporate Tax In The United States Wikipedia

Corporate Income Tax Return Filing In Japan Latest 2021 2022 Shimada Associates

Data Shows Largest Firms Benefited Most From India S Corporate Tax Cuts